Buying a home in California Real Estate in 2025 requires careful planning due to legal updates, zoning rules, and market trends. Understanding the process and potential risks ensures a smooth transaction and protects your investment.

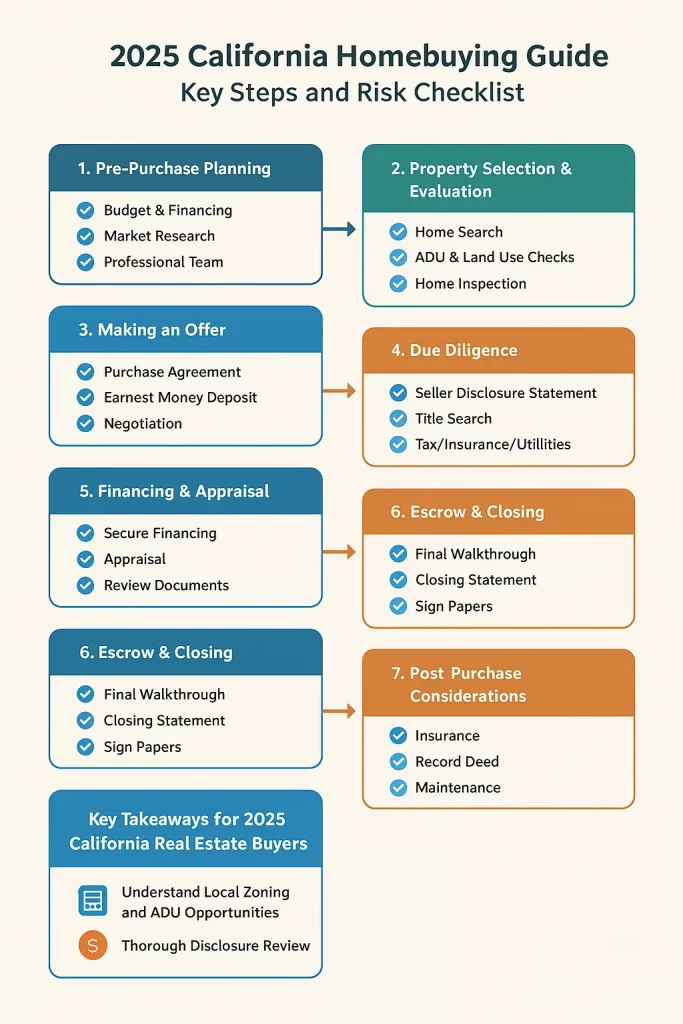

Step 1: Pre-Purchase Planning

Tasks:

- Budget & Financing: Determine mortgage pre-approval and total affordability (including property taxes and HOA fees).

- Market Research: Study neighborhoods, school districts, transportation access, and future development plans.

- Professional Team: Hire a licensed real estate agent, a real estate attorney, and consider a financial advisor.

- Risk Checklist:

- Unclear budget leading to over-leverage

- Ignoring future zoning changes or ADU opportunities

- Skipping consultation with a California Real Estate attorney

Step 2: Property Selection & Evaluation

Tasks:

- Home Search: Use MLS listings or agent guidance to identify suitable properties.

- ADU & Land Use Checks: Verify local zoning rules for Accessory Dwelling Units (ADUs) or potential multi-family conversion.

- Home Inspection: Evaluate structure, plumbing, electrical, roof, foundation, and pest issues.

- Risk Checklist:

- Zoning restrictions affecting future expansion

- Hidden structural or environmental issues

- Discrepancies between advertised and actual property features

Step 3: Making an Offer

Tasks:

- Draft a Purchase Agreement including contingencies: financing, inspection, appraisal, and disclosure review.

- Include Earnest Money Deposit (EMD) to secure the offer.

- Consider negotiation strategies based on market conditions.

- Risk Checklist:

- Overpaying due to aggressive bidding

- Ignoring contingency clauses

- Misunderstanding escrow or deposit terms

Step 4: Due Diligence

Tasks:

- Review the Seller Disclosure Statement (required under California Real Estate Law), including:

- Natural hazard zones (fire, flood, earthquake)

- Previous repairs or renovations

- HOA status and financial health

- Conduct a title search to check for liens or disputes.

- Verify property taxes, insurance requirements, and utility obligations.

- Risk Checklist:

- Undisclosed defects or hazards

- Financial instability of HOA impacting property

- Encumbrances affecting resale value

Step 5: Financing & Appraisal

Tasks:

- Lock in mortgage rates and confirm lender requirements.

- Ensure property appraisal aligns with purchase price.

- Review all loan documents carefully.

- Risk Checklist:

- Appraisal value below offer price

- Unexpected lender fees

- Failure to meet lender conditions

Step 6: Escrow & Closing

Tasks:

- Conduct final walkthrough to ensure repairs and conditions are met.

- Review closing statement including property taxes, insurance, and HOA fees.

- Sign final paperwork and transfer funds.

- Risk Checklist:

- Missing last-minute repairs

- Miscalculating closing costs

- Overlooking California Real Estate regulations impacting transfer

Step 7: Post-Purchase Considerations

Tasks:

- Secure homeowners insurance, including earthquake and fire coverage if applicable.

- Record deed with the county to establish legal ownership.

- Plan for long-term maintenance and potential ADU or remodeling projects.

- Risk Checklist:

- Not obtaining proper insurance coverage

- Failing to comply with local zoning or HOA rules

- Ignoring property tax obligations

Quick Risk & Action Table

| Step | Key Risks | California Real Estate Tips |

|---|---|---|

| Pre-Purchase | Budget misalignment, ignoring zoning | Get pre-approved; research ADU rules |

| Property Evaluation | Hidden defects, zoning limits | Hire certified inspector; check local zoning |

| Offer | Overpaying, weak contingencies | Include financing & inspection contingencies |

| Due Diligence | Unnoticed hazards, HOA issues | Review seller disclosures carefully |

| Financing | Low appraisal, unexpected fees | Confirm mortgage & appraisal alignment |

| Closing | Missing repairs, legal oversight | Final walkthrough; confirm compliance |

| Post-Purchase | Insurance gaps, tax issues | Obtain coverage; record deed; maintain property |

Key Takeaways for 2025 California Real Estate Buyers

- Understand Local Zoning and ADU Opportunities: New 2025 laws make ADUs and multi-family conversions easier, but local compliance is mandatory.

- Thorough Disclosure Review: Sellers are legally required to provide detailed property disclosures under California Real Estate Law.

- Professional Guidance is Essential: Real estate agents, attorneys, and inspectors help navigate complex laws and avoid costly mistakes.

- Plan for Natural Hazards: Earthquake, fire, and flood insurance may be required depending on location.

- Budget for All Costs: Property taxes, HOA fees, insurance, and closing costs should be fully accounted for.

By following this structured process and referring to California Real Estate Law, buyers can minimize risks and make informed decisions in 2025’s dynamic market.